“Find out which financial software suits your business in 2024—Expensify vs QuickBooks. This ultimate guide covers features, automation, invoicing, payroll, and pricing for small to large businesses.”

In today’s fast-paced business world, having the right financial management software is critical to staying ahead of the competition and keeping your finances in check. Whether you’re a small startup, a freelancer, or managing a fully operational enterprise, choosing between Expensify vs QuickBooks can dramatically impact your productivity. Both platforms offer powerful tools, but their features, pricing, and ideal users differ significantly.

In this comprehensive guide, we’ll take a deep dive into Expensify vs QuickBooks, providing detailed insights on which platform suits your business best in 2024. From expense management and invoicing to tax compliance and automation, this guide covers everything you need to make an informed decision.

TL;DR Summary

- Freelancers or Small Businesses: For businesses focused on managing expenses and staying budget-friendly, Expensify is an excellent choice. Its simplicity and affordability make it ideal for freelancers, contractors, and small teams.

- Growing Businesses: As your business expands and your financial needs grow, QuickBooks offers a full accounting suite. It handles everything from invoicing to payroll and provides detailed financial reports that help you track performance and scale operations.

- Established Enterprises: For larger businesses that need comprehensive financial management, QuickBooks provides powerful features like payroll, inventory management, tax support, and advanced reporting.

- Key Takeaway: Expensify is best for small-scale expense management, while QuickBooks offers a robust, scalable solution for growing and established businesses.

Table of Contents

Introduction to Expensify vs QuickBooks

When it comes to managing business finances, Expensify vs QuickBooks are two of the most widely used platforms available. However, they cater to slightly different user bases, each with its own strengths.

Expensify is a lightweight, intuitive expense management tool that allows users to scan receipts, submit expenses, and track spending in real-time. It’s particularly useful for businesses that need to manage reimbursements and expenses on the go. Expensify’s simplicity makes it a popular choice for freelancers, small business owners, and teams that frequently incur travel expenses.

QuickBooks, on the other hand, is a comprehensive accounting platform designed to handle every aspect of a business’s finances. From payroll and invoicing to advanced tax management and reporting, QuickBooks is an all-in-one solution. It’s ideal for growing and established businesses that need a complete overview of their financial health, with powerful automation features that minimize manual data entry.

2024: Why Now is the Time to Reevaluate Your Financial Tools

The world of financial management software is rapidly evolving, with new trends emerging that are changing the way businesses handle their finances. In 2024, the focus is on automation, scalability, and cloud-based solutions that enable businesses to manage their finances from anywhere.

Key Trends Shaping Financial Tools in 2024

- Automation is Essential

In 2024, financial management software is expected to automate more processes than ever before. From automatic receipt scanning to generating real-time financial reports, businesses are looking for ways to reduce the time spent on manual data entry. Expensify vs QuickBooks both offer automation features, but QuickBooks goes a step further with comprehensive automation across payroll, invoicing, tax filing, and reporting. - Cloud-Based Solutions Are the Norm

With more businesses shifting to remote or hybrid work models, cloud-based financial tools are a must. Both Expensify vs QuickBooks are cloud-based, allowing employees and business owners to access financial data anytime, anywhere. This flexibility is essential for teams working from different locations. - Compliance with Evolving Tax Regulations

Tax laws are continually changing, making compliance a growing concern for businesses. QuickBooks excels in this area, automatically updating tax rates and regulations to ensure businesses remain compliant with local and federal laws. While Expensify doesn’t handle tax filings, it integrates with accounting platforms to streamline the process of managing tax-deductible expenses. - Scalability for Growing Businesses

As businesses grow, their financial management needs evolve. Both Expensify vs QuickBooks offer scalability, but QuickBooks provides a more comprehensive suite of tools for businesses managing payroll, multiple employees, and various revenue streams. Expensify is better suited for smaller businesses focused on expense tracking rather than full accounting functionality.

In-Depth Feature Breakdown: Expensify vs QuickBooks

Expense Management

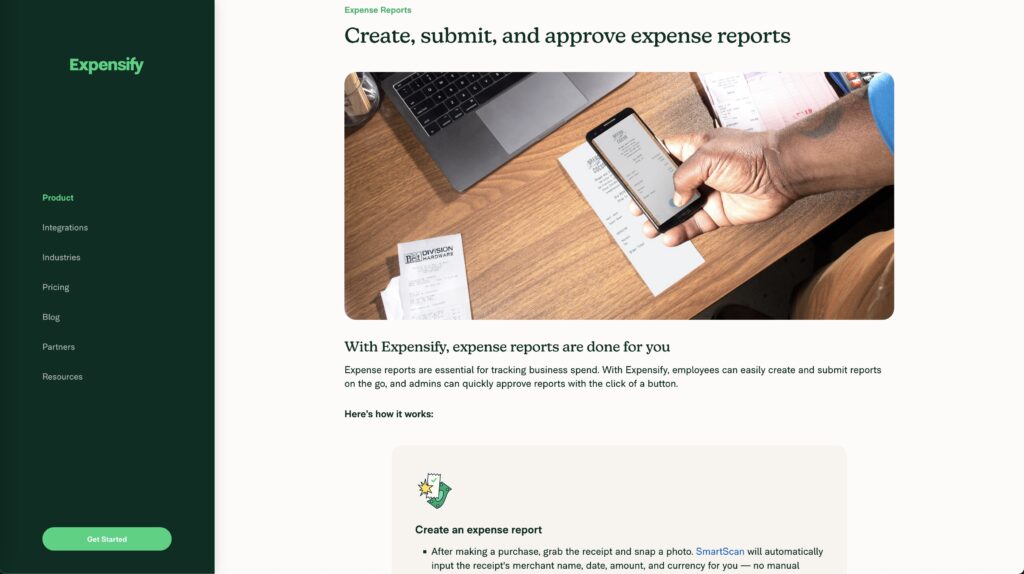

Expensify: The Master of Expense Tracking

Expense management is where Expensify shines. It simplifies the process of submitting expenses, making it easy for employees to snap photos of receipts and automatically categorize expenses. For teams that travel frequently or incur regular business expenses, Expensify ensures that expenses are tracked in real time, reducing the chances of missed receipts or delayed reimbursements.

Key features include:

- SmartScan: Automatically extracts data from receipts, eliminating manual entry.

- Approval Workflows: Set up custom approval processes for expense reports.

- Real-Time Reporting: Access to up-to-date expense data to track team spending.

QuickBooks: Integrating Expenses into the Bigger Picture

While QuickBooks also offers expense tracking, its strength lies in integrating expenses into a broader financial picture. Expenses are automatically categorized and linked to other accounting tasks, such as payroll and invoicing, giving businesses a complete view of their financial health.

Key features include:

- Automatic Categorization: Sync expenses with bank accounts and credit cards.

- Integrated Reporting: View expenses alongside other key financial metrics like revenue and profit margins.

- Budgeting Tools: Compare expenses against budgets to track financial goals.

For pure expense management, Expensify is the better option due to its simplicity and ease of use. However, if you need to integrate expense management into a broader financial ecosystem, QuickBooks is a better fit.

Invoicing and Billing: Expensify vs Quickbooks

Expensify: Basic Invoicing for Simple Needs

Expensify offers basic invoicing features, allowing freelancers and small businesses to send simple invoices to clients. While this functionality is sufficient for those who need to issue a few invoices each month, it lacks the customization and advanced billing options available in other platforms.

QuickBooks: A Full Invoicing Powerhouse

Invoicing is one of QuickBooks’ strongest features. Businesses can create customized invoices, set up recurring billing, and accept payments directly through the platform. QuickBooks also tracks when invoices are sent, viewed, and paid, streamlining the entire payment process.

Additional features include:

- Invoice Templates: Design and customize invoices with your company’s branding.

- Automatic Payment Reminders: Send reminders to clients who haven’t paid on time.

- Online Payment Integration: Accept payments via credit card, PayPal, or bank transfer.

For businesses that rely on invoicing for revenue generation, QuickBooks is the clear winner. Its powerful invoicing features make it easy to manage client payments and track outstanding invoices.

Automation and Integration: Expensify vs Quickbooks

Expensify: Streamlining Expense-Related Automation

Expensify focuses on automating expense tracking and approval workflows. Employees can snap receipts, and the system will automatically categorize expenses and submit them for approval. This makes Expensify ideal for businesses looking to reduce the time spent on manual expense entry and approval processes.

QuickBooks: Automating Financial Workflows End-to-End

Automation is one of QuickBooks’ key strengths. From automatically generating financial reports to scheduling payroll and sending recurring invoices, QuickBooks takes much of the manual labor out of managing business finances. The platform integrates with over 650 third-party apps, making it a hub for automating not just accounting, but entire business operations.

Key automation features include:

- Recurring Transactions: Automate recurring payments to vendors or clients.

- Custom Financial Reports: Schedule automated reports that are delivered directly to stakeholders.

- Payroll Automation: Pay employees and calculate payroll taxes without manual input.

If automation is a priority, QuickBooks provides the more comprehensive solution, covering everything from invoicing to payroll. Expensify is ideal for businesses that only need to automate expense tracking.

Payroll and Tax Compliance: Expensify vs Quickbooks

Expensify: No Direct Payroll, But Strong Integrations

While Expensify doesn’t offer payroll features directly, it integrates with payroll providers like Gusto and QuickBooks to ensure that reimbursable expenses are accounted for when processing payroll. This indirect integration works for small teams, but businesses with more complex payroll needs will need additional tools.

QuickBooks: Payroll and Tax Filing Made Simple

For businesses with employees, QuickBooks is the superior choice. It handles payroll processing, tax calculations, and compliance with federal, state, and local regulations. QuickBooks automatically updates tax rates and ensures that your business remains compliant with tax filings throughout the year.

Key payroll features include:

- Automated Payroll: Process payroll automatically based on employee hours and salary.

- Tax Filing: Automatically file payroll taxes and generate tax forms (W-2s, 1099s).

- Direct Deposit: Pay employees via direct deposit, ensuring timely payments.

For businesses needing payroll and tax compliance, QuickBooks is the clear choice. Its comprehensive payroll and tax features eliminate the need for additional tools.

Reporting and Analytics: Expensify vs Quickbooks

Expensify: Limited but Functional Reporting

Expensify offers basic reporting tools that allow businesses to track employee expenses and reimbursements. For small teams or companies focused on controlling travel and entertainment expenses, these reports provide enough insight to manage spending.

QuickBooks: Advanced Reporting and Analytics for Deeper Insights

QuickBooks excels in providing detailed financial reports, from profit and loss statements to balance sheets and cash flow forecasts. These reports are customizable and can be generated automatically, offering businesses a comprehensive view of their financial health.

Key reporting features include:

- Customizable Reports: Tailor reports to track specific metrics like cash flow, expenses, and revenue.

- Financial Forecasting: Use historical data to predict future financial trends.

- Tax Reports: Generate reports for tax preparation, making tax season less stressful.

For businesses needing detailed financial analysis, QuickBooks is the better option. Expensify is more suited for businesses that need simple expense-related reports.

Use Case Scenarios: Which Business Stage Suits Which Software?

Starting a Business: What to Consider

When starting a business, simplicity and cost are critical. Most startups and freelancers don’t need a full accounting suite and are more concerned with tracking expenses and managing cash flow. Expensify is ideal for this stage, offering simple tools to manage expenses without overwhelming users with unnecessary features.

Key considerations:

- Low-cost plans starting at $5 per user per month.

- Free trial version available for very basic use.

- Easy to use with minimal setup required.

Scaling a Business: The Need for Automation

As businesses grow, financial management becomes more complex. In this stage, you’ll need software that scales with you and automates repetitive tasks. QuickBooks is designed to grow with your business, offering advanced features like payroll, tax compliance, and multi-user access.

Key considerations:

- Integrated financial management tools, including invoicing, payroll, and reporting.

- Automation to reduce manual data entry and streamline operations.

- Scalability as your business adds more clients, employees, and financial transactions.

Established Enterprises: Advanced Financial Management

For larger businesses or enterprises with multiple revenue streams, more employees, and complex financial needs, QuickBooks is the go-to platform. It allows for detailed financial reporting, multi-user collaboration, and advanced tax and payroll management.

Key considerations:

- Multi-user access with role-based permissions.

- Advanced financial forecasting and reporting tools.

- Comprehensive payroll and tax compliance features.

User Experience: How Easy Are They to Use?

While both Expensify and QuickBooks are user-friendly, they cater to different levels of financial management expertise.

Expensify’s Simplicity

Expensify is designed to be intuitive and easy to use. It’s perfect for users without formal accounting training, allowing them to snap photos of receipts, categorize expenses, and submit reports with minimal effort.

QuickBooks’ Robust Functionality

QuickBooks offers a more feature-rich experience, but with this comes a steeper learning curve. However, the platform provides tutorials, guides, and a vast knowledge base to help users get up to speed quickly.

For ease of use, Expensify is the better option, especially for freelancers and small teams. QuickBooks offers more functionality but requires a bit more time to master.

Pricing Breakdown: Comparing Costs Expensify vs Quickbooks

Expensify Pricing

Expensify offers flexible pricing plans that start at $5 per user per month. For freelancers or small businesses, the free version might be sufficient, but larger teams will likely need to upgrade to access advanced features like approval workflows and higher SmartScan limits.

QuickBooks Pricing

QuickBooks pricing starts at $17.50 per month for the Essentials plan, which includes invoicing, expense tracking, and basic financial reports. For businesses needing payroll, advanced reporting, or multi-user access, the cost can go up to $117.50 per month for the Advanced plan.

For businesses focused on cost, Expensify is more affordable. However, QuickBooks provides more value for businesses that need comprehensive accounting features.

Support and Resources: Expensify vs Quickbooks

Both Expensify and QuickBooks offer customer support and extensive resources to help users troubleshoot and maximize their software.

Expensify Support

Expensify offers 24/7 chat support along with a comprehensive help center that covers common issues. Its support team is responsive, making it easy to get assistance when needed.

QuickBooks Support

QuickBooks provides a broader range of support options, including phone support, live chat, webinars, and a community forum. Higher-tier users also have access to dedicated account managers.

Alternatives to Expensify vs QuickBooks

If you’re still unsure whether Expensify vs QuickBooks is the right fit for your business, here are three alternatives to consider:

1. Xero

Xero is an accounting platform similar to QuickBooks that offers full-suite financial management tools. It’s known for its user-friendly interface and robust reporting features.

2. FreshBooks

FreshBooks is an excellent option for freelancers and service-based businesses that rely heavily on invoicing. It offers strong invoicing and expense tracking features but lacks some of the advanced accounting tools found in QuickBooks.

3. Wave

Wave is a free accounting platform that offers invoicing, expense tracking, and basic reporting tools. It’s ideal for freelancers or small businesses on a tight budget, though it lacks payroll and tax compliance features.

Conclusion: Expensify vs QuickBooks—The Winner in 2024?

Choosing between Expensify vs QuickBooks depends on your business’s unique needs and growth stage.

- Expensify is the best choice for freelancers and small businesses focused primarily on expense management. Its simplicity, affordability, and ease of use make it perfect for businesses that don’t need full-scale accounting functionality.

- QuickBooks is the clear winner for growing and established businesses that require a full accounting suite. Its advanced features, including payroll, tax compliance, and detailed reporting, make it a robust solution for businesses with more complex financial needs.

In 2024, QuickBooks will likely remain the top choice for most businesses due to its scalability, comprehensive feature set, and ability to grow alongside your company. However, for smaller teams and individuals focused on expense tracking, Expensify remains a powerful, budget-friendly option.