“Looking for the best accounting software in 2024? This detailed Autobooks vs QuickBooks comparison highlights features, pricing, and user experiences to help you decide which is best for your business.“

TL/DR Blog Summary:

In this comprehensive comparison of Autobooks vs QuickBooks, we break down the key differences between the two accounting software solutions for 2024. Autobooks is an affordable and easy-to-use platform ideal for small businesses, nonprofits, and freelancers who need basic invoicing and payment processing. QuickBooks, on the other hand, offers advanced features such as payroll, detailed financial reporting, and extensive integrations, making it perfect for growing businesses. We explore pricing, user experience, security, and customer support to help you decide which software best fits your needs, along with top alternatives like FreshBooks, Xero, and Wave.

Table of Contents

Introduction: Autobooks vs QuickBooks – What’s the Hype?

When it comes to managing your business finances, choosing the right accounting software can be a game-changer. In today’s ever-evolving digital landscape, the competition between Autobooks vs QuickBooks is heating up. Both platforms promise to simplify your financial tasks, from invoicing to payment processing, but how do you know which is the best choice for your business in 2024?

Whether you’re a small business owner, freelancer, or an entrepreneur, you’re likely already aware of the time, energy, and financial costs that accounting and bookkeeping require. With Autobooks and QuickBooks, those headaches can be minimized — but each comes with its own unique strengths and weaknesses.

In this in-depth comparison, we’ll explore every feature, pro, and con of Autobooks and QuickBooks, so you can choose the right platform for your business. Whether you’re looking for simplicity, advanced analytics, or robust integration options, we’ve got all the information you need to make the best decision.

Quick Overview: What Is Autobooks? What Is QuickBooks?

Before diving into the detailed comparison, let’s understand what each platform offers. Both Autobooks and QuickBooks are built to help businesses simplify their accounting processes, but they have different approaches to achieving this.

What is Autobooks?

Autobooks is a user-friendly accounting software designed primarily for small businesses, freelancers, and nonprofits. It focuses on providing a simplified interface for invoicing, accepting payments, and tracking financial performance. Its direct integration with banking systems makes it particularly appealing for businesses that want everything in one place. Launched in 2015, Autobooks may be newer to the accounting software game, but it has been gaining popularity due to its ease of use and intuitive design.

- Target Audience: Small business owners, freelancers, nonprofits

- Key Features: Invoicing, payment processing, cash flow management

What is QuickBooks?

QuickBooks is an industry giant, first launched in 1983, and has long been a go-to choice for businesses of all sizes. QuickBooks is best known for its wide range of tools for managing everything from payroll to taxes to advanced reporting. Its powerful integrations and deep feature set make it a strong contender for businesses that need more comprehensive accounting solutions. With its more complex offerings, QuickBooks serves a wide variety of industries, including retail, construction, and service-based businesses.

- Target Audience: Small to medium-sized businesses, larger enterprises

- Key Features: Comprehensive accounting features, payroll, tax filing, reporting, and analytics

Comparing Features: Autobooks vs QuickBooks

To help you make an informed decision, let’s dive into the core features offered by both Autobooks and QuickBooks. While both platforms cover the basics of accounting software, there are notable differences in how they handle each area.

Invoicing and Payment Processing: Autobooks vs QuickBooks

Invoicing and payment processing are essential for any business, and both Autobooks and QuickBooks handle these tasks well. However, they offer different experiences based on the size and needs of your business.

- Autobooks: Has an edge when it comes to simplicity. The software is streamlined for small businesses, allowing users to send invoices and accept payments directly within the system. Autobooks integrates with bank accounts, enabling businesses to receive payments quickly and efficiently. It also offers automatic payment reminders, which can reduce the time you spend chasing overdue invoices.

Pros: Simplified, easy-to-use interface, seamless payment integration. Cons: Limited customization options for invoices.

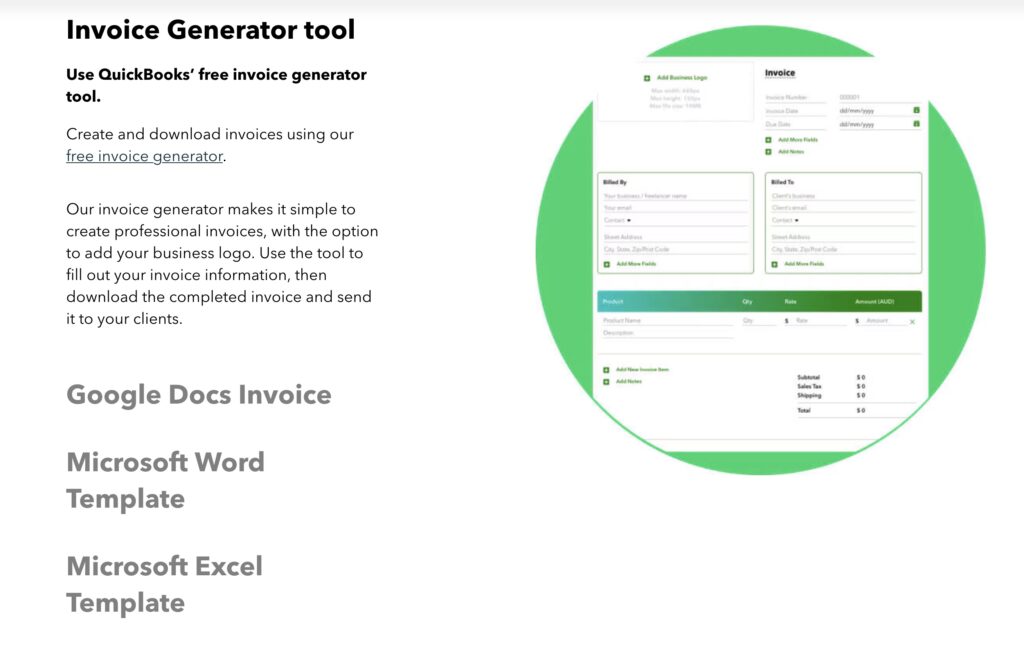

- QuickBooks: While QuickBooks also provides robust invoicing tools, it is far more customizable. You can create recurring invoices, offer multiple payment methods, and integrate seamlessly with third-party payment processors. QuickBooks also gives users more control over payment reminders and invoice design, making it a better choice for businesses needing extensive customization.

Pros: Highly customizable, supports multiple payment gateways.

Cons: More complex, longer learning curve.

Financial Reporting and Analytics: Autobooks vs QuickBooks

Every business needs insights into their financial performance, and the quality of reporting tools is crucial.

- Autobooks: Offers basic financial reports, such as profit and loss statements, balance sheets, and cash flow summaries. These are easy to generate and perfect for businesses that don’t need complex analytics but want a quick snapshot of their financial health.

Pros: Simplified, easy-to-understand reports.

Cons: Limited depth for more advanced users. - QuickBooks: Provides a wide array of customizable reports, such as profit and loss, tax summaries, expense reports, and advanced forecasting tools. QuickBooks allows you to drill down into specific details, helping larger businesses understand key financial metrics.

Pros: Advanced reporting and analytics tools, highly customizable.

Cons: Can be overwhelming for users who don’t need deep analysis.

Customer Management: Autobooks vs QuickBooks

Both platforms offer customer management tools, allowing you to track customer payments, manage invoices, and monitor financial interactions.

- Autobooks: Keeps things simple by offering a dashboard that tracks all customer interactions. It automatically matches payments to invoices, making it easy to stay on top of your customers’ payment histories.

Pros: Great for small businesses that need basic customer tracking.

Cons: No advanced customer management features. - QuickBooks: Customer management system is far more robust. You can create detailed customer profiles, track project expenses, generate reports based on customer activity, and even automate follow-up actions. This feature is excellent for businesses with complex customer interactions.

Pros: Comprehensive customer management.

Cons: Might be too detailed for smaller businesses.

Expense Tracking and Categorization: Autobooks vs QuickBooks

Tracking and categorizing expenses is critical for accurate accounting, especially come tax time.

- Autobooks: Offers simplified expense tracking that links directly to your business’s bank account. Expenses can be automatically categorized, which makes it easier to stay organized. However, Autobooks lacks some advanced expense-tracking tools.

Pros: Automatic categorization, direct bank integration.

Cons: No advanced expense tracking.

- QuickBooks: Expense tracking is one of QuickBooks strong suits. You can manually categorize expenses, scan receipts, and even set up rules to automatically categorize future expenses. QuickBooks also allows you to link multiple accounts, credit cards, and loans to your expenses for a complete financial overview.

Pros: Comprehensive and customizable expense tracking.

Cons: Higher complexity for new users.

Payroll Management: Autobooks vs QuickBooks

If your business has employees, payroll is likely a significant component of your accounting needs.

- Autobooks: Does not offer a built-in payroll feature. If you need payroll, you would need to integrate with third-party payroll services.

Pros: Not applicable.

Cons: No built-in payroll solution. - QuickBooks: Offers a full-fledged payroll service, complete with tax filing, direct deposit, and employee management features. You can automate payroll runs, calculate taxes, and even generate employee benefits reports.

Pros: Comprehensive payroll solution.

Cons: Can be expensive for smaller businesses.

Pricing Breakdown: Autobooks vs QuickBooks

Cost is often a determining factor when choosing accounting software. Let’s break down the pricing for Autobooks vs QuickBooks:

Autobooks Pricing

Autobooks offers simple, affordable pricing. Most plans start at $10 per month, plus transaction fees for payments processed through the platform. This makes it a great choice for businesses on a budget or those looking for a lightweight accounting tool. However, the lack of advanced features may make Autobooks less appealing to larger businesses with complex accounting needs.

- Plan Details: Starts at $10/month.

- Transaction Fees: 1% per transaction for ACH payments, 2.89% + 30¢ per transaction for credit/debit cards.

QuickBooks Pricing

QuickBooks offers a tiered pricing structure, which ranges from $9.50/month for the Simple Start plan to $35+/month for the Advanced plan. This range gives businesses flexibility depending on their needs and growth. QuickBooks also offers payroll and other advanced add-ons, which can increase the cost but add significant value for larger businesses.

- Plan Details: Simple Start ($9.50/month), Essentials ($13.50/month), Plus ($19/month), Advanced ($35/month).

- Transaction Fees: Standard transaction fees apply for payment processing through QuickBooks.

User Experience: Which Software Is Easier to Use? Autobooks vs QuickBooks

Autobooks:

The user-friendly interface of Autobooks is one of its strongest selling points. It’s designed for users who may not have a background in accounting or bookkeeping. The dashboard is clean and intuitive, with easy-to-navigate menus for invoicing, payment processing, and reporting.

QuickBooks:

While QuickBooks offers more features, its interface can feel overwhelming, especially for new users. QuickBooks is often considered the more complex of the two platforms, requiring more time to learn but providing far more customization options for businesses that need them.

Mobile Accessibility: On-the-Go Management Autobooks vs QuickBooks

In today’s fast-paced business environment, mobile accessibility is a must-have feature.

- Autobooks: Has a streamlined mobile app that focuses on basic tasks like sending invoices, viewing payment statuses, and managing customer payments. It’s designed for users who need quick, on-the-go access to essential accounting tasks.

Pros: Simplified mobile experience, perfect for small business owners.

Cons: Limited functionality compared to desktop version.

- QuickBooks: Offers a more feature-rich mobile app, allowing users to manage expenses, generate reports, and even snap photos of receipts for real-time expense tracking. However, the increased functionality may make it feel overwhelming for users who just want to complete simple tasks.

Pros: Advanced mobile features, great for larger businesses.

Cons: More complex interface on mobile.

Security and Compliance: Keeping Your Data Safe Autobooks vs Quickbooks

Both Autobooks and QuickBooks prioritize security and compliance, but there are a few key differences.

Autobooks:

Autobooks uses bank-level encryption and complies with all necessary financial regulations. Because it’s often integrated directly with your bank, Autobooks provides a seamless, secure experience for managing payments and financial data. However, it lacks some of the advanced security features that larger companies might require, like custom user roles or additional compliance certifications.

QuickBooks:

QuickBooks provides top-tier security with multi-factor authentication, data encryption, and automatic backups. It’s also compliant with major industry standards, making it a solid choice for businesses that require more robust security measures. QuickBooks also allows administrators to set user permissions, making it safer for businesses with multiple team members accessing financial data.

Customer Support: Autobooks vs QuickBooks

Good customer support is essential for any accounting software, especially when you encounter issues.

Autobooks:

Autobooks offers email and phone support, and because it serves a smaller user base, many customers report faster response times and more personalized service. Autobooks also offers helpful onboarding resources, making it easy to get started quickly.

Pros: Personalized, faster customer support.

Cons: Limited support hours compared to larger platforms.

QuickBooks:

QuickBooks provides 24/7 support across various channels, including live chat, email, and phone. However, the sheer size of QuickBooks’ user base can lead to longer wait times and less personalized support. Additionally, many QuickBooks users rely on community forums and self-help resources for quicker solutions.

Pros: Multiple support channels, including live chat.

Cons: Longer response times, less personal support.

Integrations and Add-Ons: Expanding Capabilities of Autobooks vs Quickbooks

In today’s interconnected software ecosystem, the ability to integrate with other tools is crucial.

- Autobooks: Has limited integration options compared to QuickBooks. Its primary integration is with banking platforms, making it easy for small businesses to manage everything in one place. However, if you need additional software integrations, Autobooks might not be the best choice.

Pros: Seamless bank integration.

Cons: Limited third-party integrations. - QuickBooks: Offers a vast library of third-party integrations, including CRM tools, payment processors, and even industry-specific software. QuickBooks also integrates with Gusto for payroll, Shopify for e-commerce, and HubSpot for customer management, making it an all-in-one solution for businesses looking to scale.

Pros: Extensive integration library.

Cons: More complex to manage multiple integrations.

Real User Reviews: Autobooks vs QuickBooks

What do real users have to say about Autobooks vs QuickBooks?

Autobooks:

Most users of Autobooks rave about how easy it is to get started. Small business owners love the simplified interface and quick setup, especially for handling invoicing and payments. However, some users mention that they outgrow the platform as their business scales due to the lack of advanced features.

User Review: “Autobooks is perfect for our small nonprofit. We don’t need complicated reports or features, and Autobooks makes managing donations and payments super easy!”

QuickBooks:

QuickBooks has millions of users and is known for its depth of functionality. Businesses of all sizes appreciate the comprehensive set of tools it offers, but new users often mention the steep learning curve. Some users feel that QuickBooks is more suitable for larger businesses that require a higher level of customization and reporting.

User Review: “QuickBooks has everything we need to manage payroll, taxes, and invoicing. The learning curve was steep, but once we got the hang of it, we couldn’t imagine running our business without it.”

Who Should Choose Autobooks? Who Should Choose QuickBooks?

Choose Autobooks if:

- You run a small business, nonprofit, or freelance operation.

- You need straightforward invoicing and payment processing tools.

- You want a simple, easy-to-use interface without too many advanced features.

Choose QuickBooks if:

- You have a growing business that requires more advanced accounting tools.

- You need comprehensive reporting, payroll, and tax features.

- You have experience with accounting software or are willing to invest time in learning the system.

Top 3 Alternatives to Autobooks and QuickBooks

Looking for more options? Here are three highly-searched alternatives to Autobooks and QuickBooks that can provide robust accounting solutions for different types of businesses:

1. FreshBooks

- Why Choose FreshBooks? FreshBooks is known for its user-friendly interface and is perfect for freelancers and small business owners. It offers excellent invoicing features, time-tracking tools, and expense management.

- Ideal For: Freelancers, solo entrepreneurs, and small businesses.

- Pricing: Starts at $5.70/month.

2. Xero

- Why Choose Xero? Xero offers cloud-based accounting solutions with a focus on automation and integrations. It’s great for businesses that need multi-currency support, comprehensive reporting, and strong project tracking capabilities.

- Ideal For: Small to medium-sized businesses, e-commerce businesses.

- Pricing: Starts at $7.25/month.

3. Wave

- Why Choose Wave? Wave is a free accounting solution that offers many of the core features provided by paid software. It’s an excellent choice for freelancers and small businesses with limited budgets.

- Ideal For: Freelancers and small businesses on a tight budget.

- Pricing: Free, with pay-as-you-go pricing for payment processing.

Conclusion: Autobooks vs QuickBooks?

At the end of the day, choosing between Autobooks vs QuickBooks depends entirely on the size and needs of your business. Autobooks is a great choice for small businesses or nonprofits that need an affordable, easy-to-use platform with straightforward invoicing and payment processing features. On the other hand, QuickBooks is a feature-rich platform that offers advanced tools for businesses looking to grow and scale their operations, including payroll, detailed financial reporting, and third-party integrations.

If you’re a small business or freelancer looking for something simple and cost-effective, Autobooks might be your best bet. If you need advanced features and don’t mind a bit of a learning curve, QuickBooks could be the perfect solution.

No matter which you choose, both platforms can make managing your business finances easier and more efficient in 2024!