Are you struggling to decide between Wave vs Xero for your business? This 2024 guide will provide you with a detailed comparison to help you choose the best accounting software for your unique needs.

Table of Contents

Introduction to Wave vs Xero

When it comes to running a successful business, keeping your finances in order is non-negotiable, regardless of your company’s size. Whether you’re managing a freelance gig, running a small business, or steering a rapidly expanding enterprise, your accounting software plays a critical role in how well you handle daily operations. From tracking income and expenses to managing payroll and ensuring tax compliance, the right tools can streamline your workflow and provide peace of mind.

But not all accounting software is built the same. That’s where the choice between Wave vs Xero comes into play—two of the most popular platforms in 2024 for businesses seeking efficient financial management solutions. Both tools serve different types of businesses, but they excel in their own ways depending on your requirements.

Wave is a standout in the accounting world due to its attractive pricing model: it’s free. That’s right—Wave offers an array of basic accounting features without a price tag, which is especially appealing for freelancers, solopreneurs, and small businesses looking to minimize costs without sacrificing essential financial management capabilities. Its simple interface and straightforward features are perfect for businesses that have basic needs but don’t require extensive accounting functions or third-party integrations.

On the other hand, Xero is a premium accounting platform that’s designed to grow with your business. As a paid service, Xero brings more robust features to the table, catering to companies that need to scale their financial operations. With Xero, businesses get access to sophisticated tools for handling multi-currency transactions, payroll, detailed financial reporting, and advanced inventory management. It’s an excellent option for businesses that expect to grow, have more complex accounting needs, or operate across multiple locations or countries.

So, how do you decide between Wave vs Xero? It all comes down to your business size, current financial requirements, and long-term growth plans. While Wave offers simplicity and affordability, Xero provides the depth and scalability that larger, more complex businesses need to thrive.

In this comprehensive comparison, we’ll dive deep into the core features of both platforms, including invoicing, expense tracking, payroll, integrations, and pricing. By the end of this guide, you’ll have a clearer understanding of which software best aligns with your business needs—whether you’re a small startup looking to save on overhead costs or an established company searching for advanced tools to manage your growing operations efficiently.

Making an informed choice between Wave vs Xero can dramatically improve how you manage your business finances and set you on the path toward sustainable growth in 2024 and beyond. Let’s dive in and find out which accounting solution is the best fit for your unique business journey.

Wave vs Xero Core Accounting Features

Basic Accounting Tools: Wave vs Xero

Both Wave vs Xero offer the fundamental accounting tools needed to run a business, but the depth and complexity of these features cater to different business types and needs. While Wave is ideal for smaller operations looking for simplicity, Xero delivers more comprehensive tools for businesses that require advanced financial management.

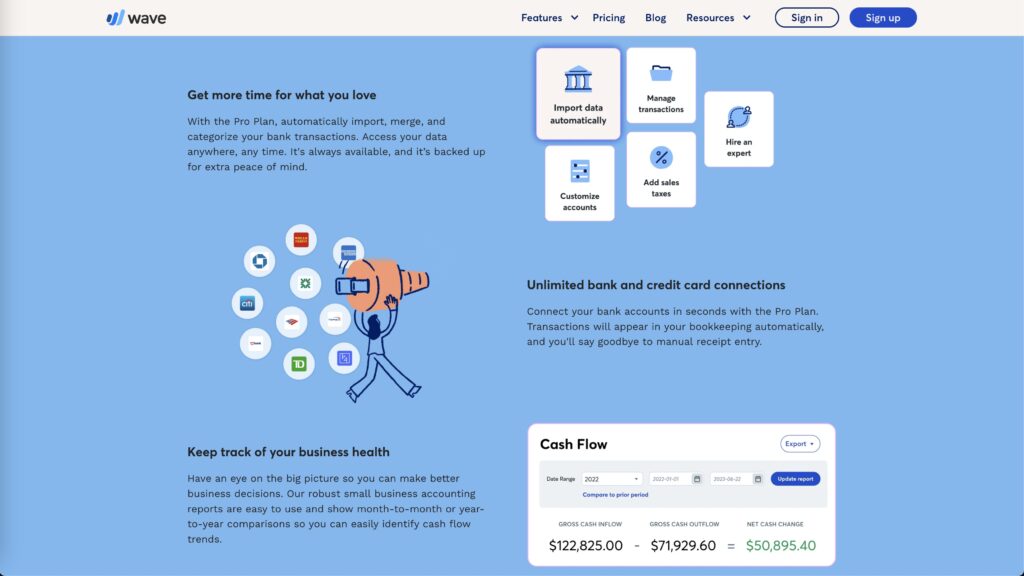

Wave’s Basic Accounting Tools

In the Wave vs Xero comparison Wave is known for its user-friendly platform and attractive free pricing model. The platform provides all the essential tools that a freelancer, solopreneur, or small business owner needs to manage their finances efficiently. Here’s what Wave offers in Wave vs Xero:

- Double-entry accounting system: Wave uses the standard double-entry accounting method, which ensures your financial records are accurate and transparent. This system is designed to keep your books balanced, helping you avoid common accounting errors.

- Bank transaction synchronization: Wave allows you to easily link your bank accounts and credit cards to the platform. Once connected, it automatically imports your transactions and categorizes them based on predefined rules. This feature significantly reduces the manual effort required for bookkeeping, making financial management more efficient and less prone to error.

- Customizable financial reports: With Wave, you can generate key financial reports such as profit and loss statements, balance sheets, and cash flow reports. These reports are crucial for keeping track of your business’s financial health, and Wave’s simple interface makes it easy to pull these insights whenever you need them.

While Wave’s simplicity and free offering are great for small businesses or freelancers with straightforward accounting needs, its feature set is somewhat limited. As your business grows or becomes more complex, you may find Wave’s tools insufficient to handle advanced accounting operations.

Xero’s Basic Accounting Tools

Xero, by contrast, provides a more robust suite of accounting tools designed for businesses with more complex financial requirements. Here’s a breakdown of what Xero brings to the table in the Wave vs Xero basic accounting tools comparison:

- Customizable and advanced reports: Xero offers a much wider range of reporting options, including detailed profit and loss statements, cash flow forecasts, and project-specific financial tracking. These advanced reports provide deeper insights into your business’s performance, allowing for better financial planning and analysis.

- Bank rules and automatic reconciliation: One of Xero’s standout features is the ability to set up bank rules, which automate the categorization of transactions. Once your bank accounts are connected, Xero not only imports transactions but also uses predefined rules to automatically reconcile them. This saves significant time and effort, especially for businesses dealing with a high volume of transactions.

- Inventory management: For businesses that sell products, inventory management is a critical feature, and Xero offers a built-in system to track inventory levels, manage product listings, and calculate cost of goods sold. This feature is particularly useful for retail businesses or any company that needs to keep tabs on stock levels and sales performance.

Xero’s depth of features makes it ideal for businesses that require more advanced tracking and more complex financial operations. For companies with multiple projects, diverse revenue streams, or international transactions, Xero’s tools go beyond what Wave offers, giving businesses the power to manage more intricate financial processes.

Invoicing & Payments: Wave vs Xero

Invoicing is a critical component of managing your business’s cash flow, and both Wave vs Xero offer robust invoicing solutions. However, the depth and complexity of their invoicing features differ significantly, catering to different types of businesses and needs.

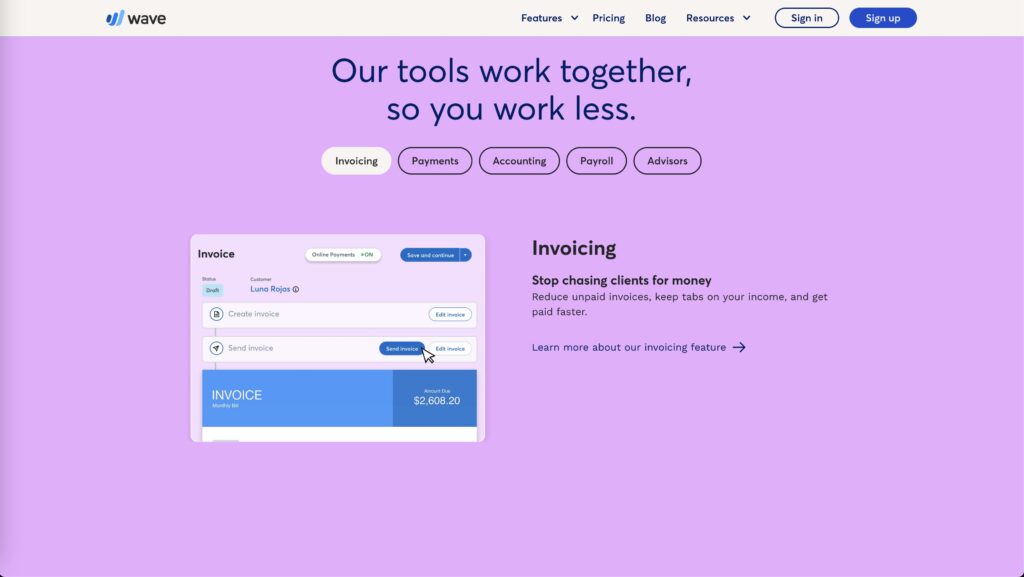

Wave Invoicing & Payments

In Wave vs Xero invoicing and payments systems Wave’s invoicing system is a standout feature, especially because it’s completely free. It’s designed with freelancers, solopreneurs, and small business owners in mind, helping them simplify and streamline their billing processes without incurring extra costs. Despite being a free tool, Wave offers a range of helpful features:

- Unlimited invoicing: Wave allows you to send an unlimited number of invoices to your clients at no cost. You can easily customize invoice templates to match your branding, adding your logo, business name, and contact details to ensure that your invoices look professional.

- Payment processing: Wave enables businesses to accept payments via credit card and ACH bank transfers directly from the invoice. This built-in payment processing allows your clients to pay easily and quickly, helping you get paid faster. However, Wave does charge a transaction fee for these payments (2.9% + $0.30 per credit card transaction and 1% for ACH transfers).

- Recurring billing and automatic reminders: For businesses that have clients on a retainer or those with recurring payments (such as subscription services), Wave simplifies the process by offering automated recurring invoices. You can set these to be sent at regular intervals, ensuring you never miss a billing cycle. Additionally, Wave’s automatic payment reminders help you follow up on unpaid invoices without having to manually track them, improving your cash flow and reducing late payments.

Overall in Wave vs Xero, Wave’s invoicing system is ideal for smaller businesses with straightforward invoicing needs. It lacks more advanced features like multi-currency support or customizable payment terms, but for freelancers and small businesses looking to send professional invoices for free, Wave is an excellent solution.

Xero Invoicing & Payments

On the other hand in Wave vs Xero invoicing and payments department, Xero offers a more advanced and versatile invoicing system, making it a better fit for businesses with more complex invoicing requirements. Xero is specifically designed for growing businesses or companies that handle larger volumes of invoices, multiple currencies, or custom payment terms.

- Multi-currency invoicing: One of Xero’s standout features is its ability to handle invoices in multiple currencies. This makes it ideal for businesses that have international clients or operate in multiple countries. With Xero, you can send invoices in your client’s preferred currency, and the platform automatically calculates currency conversions based on real-time exchange rates, ensuring accuracy and helping you avoid errors in international billing.

- Custom payment terms: Xero provides flexibility when it comes to setting payment terms for each client. You can customize due dates, offer early payment discounts, and even allow partial payments, all of which can be tailored to fit the specific needs of your clients. This flexibility is particularly useful for businesses working with long-term or high-volume clients who may require more personalized payment terms.

- Real-time invoice tracking: Xero’s real-time tracking feature allows you to monitor the status of your invoices. You can see when a client has viewed an invoice, giving you valuable insight into whether your invoice has been received and is being processed. Additionally, you can track when payments are made, ensuring that your cash flow stays predictable and transparent. This feature can save time and improve client communication by eliminating the need for follow-up emails to confirm invoice receipt.

For Wave vs Xero is clear Xero’s invoicing system is highly customizable and ideal for businesses that handle larger volumes of invoices, have international clients, or require flexibility in their payment terms. While it comes with a cost, the range of features provided makes it a powerful tool for managing invoicing in a more complex financial environment.

Expense Tracking: Wave vs Xero

Accurate expense tracking is vital for managing your cash flow, keeping your finances in check, and preparing for tax season. Both Wave vs Xero provide expense tracking features, but the depth and complexity of their tools vary significantly, making them suitable for different types of businesses. In this section, we’ll explore how these two platforms manage expenses and which one might be the better fit for your business.

Wave Expense Tracking

Wave offers a simple yet effective expense tracking solution, making it an excellent choice for freelancers and small businesses that want to keep things streamlined. Since Wave’s core services are free, its expense tracking is designed to be user-friendly without overwhelming you with too many features. Here’s what Wave offers in terms of expense tracking in Wave vs Xero:

- Automated expense categorization: Wave syncs directly with your bank accounts and credit cards, allowing it to automatically import transactions. Once imported, transactions are categorized based on predefined rules. This automation significantly reduces manual data entry, ensuring that your books stay organized and up to date with minimal effort.

- Receipt scanning: Wave’s mobile app allows users to scan receipts on the go, which can be automatically matched with corresponding transactions in the system. This is particularly useful for freelancers or small business owners who need to keep track of business expenses while traveling or on the move. Simply snap a picture of your receipt, and Wave will handle the rest.

- Simple cash flow tracking: Wave provides clear and concise reports that allow you to track your cash flow and analyze your spending habits. By viewing categorized expenses, you can gain insights into where your money is going and how to optimize your spending for better financial health. Whether it’s for day-to-day operations or tax preparation, Wave’s expense tracking tools make it easy to stay on top of your finances.

While Wave’s expense tracking may not offer the extensive features found in more robust systems, it covers all the essential bases for freelancers and small business owners. If you’re looking for a straightforward and free solution that simplifies expense management, Wave is a solid choice.

Xero Expense Tracking

In the Wave vs Xero comparison of expense tracking, Xero offers a more advanced expense tracking system that is well-suited for medium to large businesses with more complex financial needs. Xero goes beyond basic expense management by providing a range of tools that help businesses manage project-specific costs, approvals, and multi-user workflows. Here are some of the key features in Wave vs Xero:

- Project-based expense tracking: For businesses that operate multiple projects or work on a client-by-client basis, Xero allows you to track expenses related to specific projects. This feature is particularly beneficial for service-based businesses or agencies where it’s important to keep client-related costs separate from general expenses. With Xero, you can easily see how much you’re spending on a particular project and ensure profitability.

- Expense approval workflows: Larger businesses often need more control over their expense processes, and Xero’s approval workflows make this possible. Managers can review, approve, or reject expenses before they’re finalized, giving them oversight over team spending and ensuring that only authorized expenses are recorded. This additional layer of approval helps businesses maintain better financial control, especially in organizations with multiple employees submitting expenses.

- Multi-user access: Xero allows multiple team members to submit expenses, which is essential for businesses with departments or remote teams. Employees can upload receipts, categorize their expenses, and submit them for approval—all within the same system. This collaborative approach ensures that all expenses are captured in one place and that financial processes run smoothly across the entire organization.

For expense tracking in Wave vs Xero, it’s clear to see that businesses with complex expense management needs or those handling a high volume of transactions find that Xero offers the advanced functionality required to manage expenses at scale. Whether it’s tracking project costs, managing approvals, or enabling multiple users to collaborate, Xero’s tools provide greater flexibility and control.

Payroll Services: Wave vs Xero

Managing payroll is an essential function for many businesses, ensuring employees are paid accurately and on time while maintaining compliance with tax regulations. Both Wave vs Xero offer payroll services, but their features and availability vary, making them suitable for different business needs. Let’s dive into the key differences between Wave vs Xero and how these two platforms handle payroll management.

Wave Payroll

Wave provides payroll services tailored primarily to small businesses, but it’s important to note that these services are only available to businesses located in the U.S. and Canada. While Wave’s payroll offering is not part of its free plan, it remains affordable and integrates seamlessly with Wave’s other accounting features, making it a convenient choice for users who are already managing their finances with Wave. Here are some of the core elements of Wave’s payroll system in Wave vs Xero:

- Direct deposit: With Wave’s payroll service, you can pay your employees via direct deposit, ensuring that payments are made promptly and securely. This automated payment method eliminates the need for physical checks, reducing administrative time and providing employees with a reliable payment schedule.

- Automatic tax filing: One of the standout features of Wave’s payroll system is its ability to handle payroll tax calculations and filings automatically. This takes a significant burden off your shoulders, as Wave will calculate, withhold, and file payroll taxes on your behalf. This is particularly useful for small businesses that may not have dedicated HR or finance teams to manage these tasks manually.

- Employee self-service portal: Wave’s payroll platform also includes an employee self-service portal, which allows your employees to access their pay stubs, review tax forms, and update their personal information as needed. This feature not only saves time for employers but also gives employees more autonomy over their payroll data, ensuring they have easy access to important documents without having to request them manually.

While Wave’s payroll service offers great value for small businesses with straightforward payroll needs, its limited geographic availability can be a drawback for businesses operating outside of the U.S. and Canada. For businesses within those regions, however, Wave provides an affordable, streamlined payroll solution that integrates smoothly with the rest of the Wave accounting platform.

Xero Payroll

In comparison, Xero offers a more comprehensive payroll service that is available in multiple countries, making it a more versatile option for businesses with international operations or employees in different regions. Xero’s payroll system is designed for medium to large businesses that require more robust features and flexibility. Here’s what Xero brings to the table in Wave vs Xero:

- Global payroll management: One of the key strengths of Xero’s payroll system is its ability to support payroll in multiple countries. This makes Xero particularly suitable for businesses with international teams or those expanding into new markets. The platform automatically adjusts for different tax laws and regulations in each country, simplifying the payroll process and ensuring compliance across borders.

- Time-off management: In addition to handling payroll, Xero’s system includes features for managing employee leave. Businesses can track vacation days, sick leave, and other time-off requests directly within the platform. This integration ensures that time-off is accounted for accurately in payroll calculations and helps businesses stay organized when it comes to managing employee schedules and entitlements.

- Custom pay schedules: For businesses with diverse workforces, Xero provides the flexibility to create multiple pay schedules. Whether you have hourly employees, salaried staff, or contractors, Xero allows you to set up custom pay periods and schedules for different groups of employees, ensuring that everyone is paid according to their contract terms. This feature is particularly useful for businesses with varying employee payment structures.

Xero’s payroll system is ideal for medium to large businesses that need more comprehensive payroll management. Its global capabilities, time-off management, and flexibility in pay schedules make it a powerful tool for companies with complex payroll needs. For businesses with international teams or a growing workforce, Xero’s payroll features provide the scalability and sophistication needed to manage payroll efficiently and accurately.ore advanced payroll functionality and global coverage.

Wave vs Xero Pricing: Which Software Delivers More Value?

When choosing between Wave vs Xero, pricing is often one of the most critical factors for businesses, especially for small enterprises or freelancers looking to optimize their budget. Both platforms offer distinctly different pricing models, and understanding these can help you determine which one provides the best value for your specific business needs.

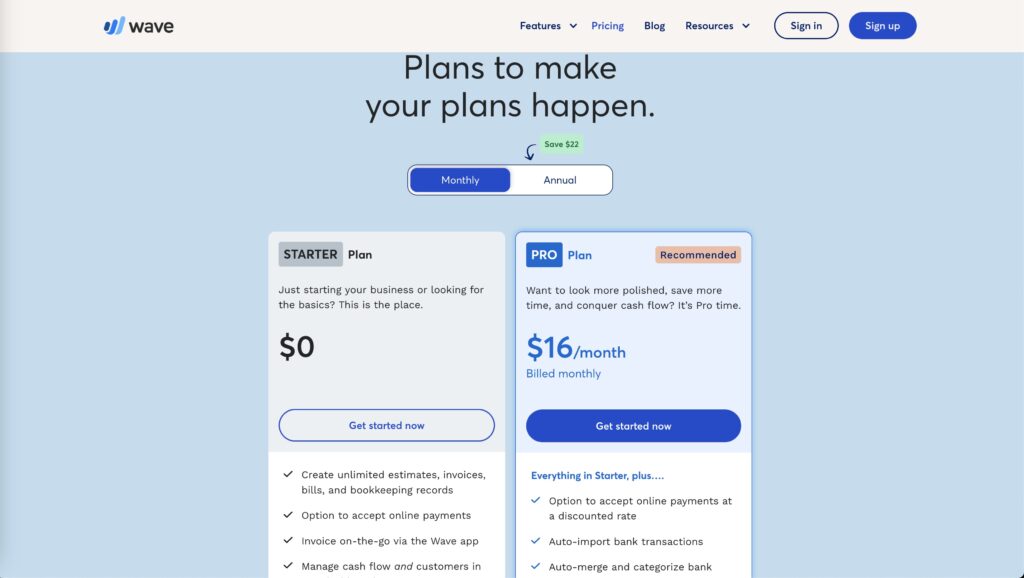

Wave Pricing

One of the key reasons Wave is so popular among freelancers and small business owners is its unique free pricing model. Wave allows users to access core accounting services without paying a subscription fee, making it an attractive option for businesses that are focused on cost-saving. Here’s a breakdown of what Wave offers in Wave vs Xero pricing:

- Core accounting services: Free

Wave’s free plan includes essential features like invoicing, expense tracking, and receipt scanning. This allows businesses to manage their financials at no cost, which is a major advantage for startups, freelancers, and small businesses with limited budgets. You can send unlimited invoices, track expenses, and generate financial reports—all without paying a penny. - Payroll services: Starts at $20/month

While Wave’s core accounting features are free, payroll services come at an additional cost. The payroll feature is available for U.S. and Canadian businesses and starts at $20 per month. The price increases depending on the number of employees. For small teams, Wave’s payroll pricing remains competitive and integrates seamlessly with its other accounting tools. - Payment processing fees:

If you choose to accept payments via Wave’s payment processing system, there are transaction fees involved. These fees are standard in the industry: 2.9% + 30¢ per credit card transaction and 1% per ACH bank transfer. While the core services are free, businesses that rely heavily on online payments may need to consider these processing costs when calculating overall expenses.

In the pricing comparison of Wave vs Xero, we see Wave’s free pricing model makes it highly appealing to freelancers, solopreneurs, and small businesses that need basic accounting features without the burden of a monthly subscription. If you’re just starting out or run a business with minimal financial complexity, Wave offers incredible value by providing essential tools at no cost. The only potential costs to consider are for payroll services or payment processing, but these are only incurred as needed.

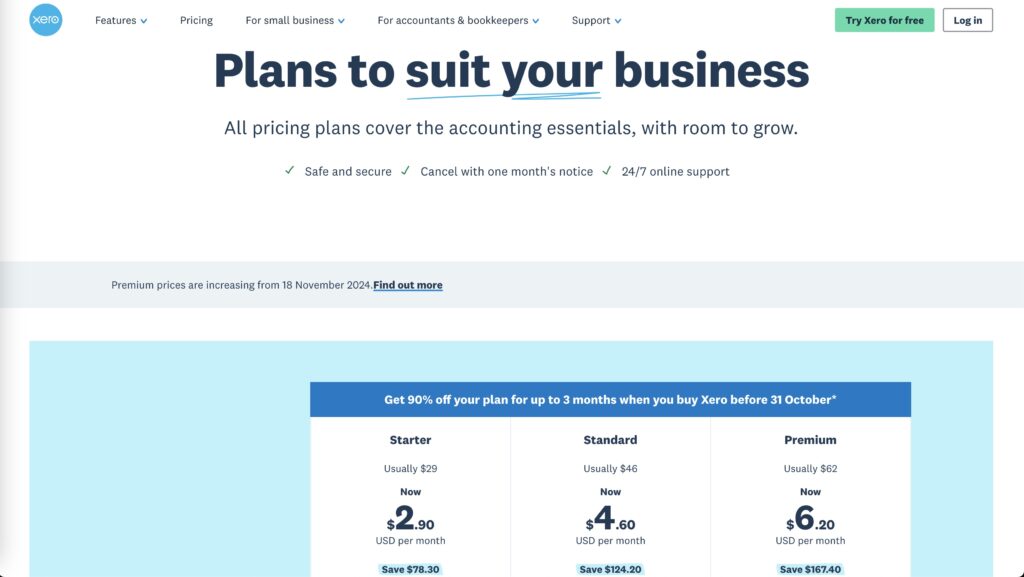

Xero Pricing

Unlike Wave, Xero operates on a tiered subscription model, offering multiple pricing plans to suit businesses of different sizes and needs. Xero’s pricing structure is designed to scale with your business, offering more advanced features as you move up the pricing tiers. Here’s how Xero’s pricing breaks down in the Wave vs Xero pricing comparison:

- Starter Plan: $13/month

The Starter Plan is ideal for sole traders, freelancers, and very small businesses that only need basic accounting features. It includes essential tools like bank reconciliation, invoicing, and expense tracking. However, the Starter Plan comes with limitations, such as a cap on the number of invoices you can send, making it suitable only for businesses with minimal accounting requirements. - Growing Plan: $37/month

Xero’s Growing Plan is the most popular option for small to medium-sized businesses. It offers unlimited invoicing, bill tracking, and bank reconciliation. This plan provides more flexibility and scalability for growing businesses with a moderate level of accounting needs. If your business is expanding and you require more features, such as the ability to manage multiple clients or handle a higher volume of transactions, the Growing Plan is a solid choice. - Established Plan: $70/month

For larger businesses or companies with complex financial requirements, the Established Plan offers the full suite of Xero’s advanced features. In addition to everything in the Growing Plan, the Established Plan includes multi-currency support, detailed project tracking, and expense management for larger teams. This plan is designed for businesses that operate internationally or need to track finances across multiple departments or projects.

One of the key advantages of Xero’s tiered pricing model is that it scales with your business as it grows. Whether you’re a small business just starting out or a larger company with more complex accounting needs, Xero offers a pricing plan that can fit your current requirements while allowing room for future growth.exibility as you grow. However, it may be too costly for smaller businesses or freelancers who don’t need advanced features.

Integrations & Add-ons: Wave vs Xero

In today’s increasingly interconnected business landscape, the ability to integrate accounting software with other essential tools is crucial for streamlining operations and increasing efficiency. Both Wave vs Xero offer integration capabilities, but the range and depth of these integrations differ considerably. Xero’s integration ecosystem is much broader, catering to businesses with more complex workflows, while Wave provides basic but sufficient integrations for small businesses and freelancers.

Wave Integrations

Wave offers a limited but effective set of integrations that meet the core needs of small businesses and freelancers. These integrations are designed to automate processes and provide basic connections to other platforms, helping users extend the functionality of Wave without adding complexity. Here are some of the key integration options available with Wave vs Xero:

- Zapier: Zapier is a powerful automation tool that connects Wave with over 1,000 other apps. Through Zapier, you can create automated workflows (called “Zaps”) between Wave and other applications like Slack, Trello, or Google Drive. This allows users to automate tasks like sending notifications for new invoices or exporting data to other platforms without manual intervention.

- Google Sheets: Wave allows users to export their financial data into Google Sheets for additional analysis and reporting. This integration is useful for small businesses that need to customize financial reports or perform data analysis outside of the Wave platform. You can easily transfer your financial records and generate custom reports using Google Sheets’ built-in functions.

While these integrations cover the basic needs of small businesses, Wave’s limited integration options may pose challenges as your business grows. Companies with more complex requirements, such as those needing advanced e-commerce or CRM tools, may find Wave’s selection of integrations somewhat restrictive. However, for freelancers and small businesses with straightforward needs, Wave’s integrations are sufficient to get the job done without unnecessary complexity.

Xero Integrations

In contrast, Xero boasts a robust ecosystem of over 700 integrations and third-party apps, making it one of the most versatile accounting platforms available. This extensive range of add-ons allows businesses to connect Xero with nearly every aspect of their operations, from e-commerce and customer relationship management (CRM) to payment processing and project management. Here are some of the standout integrations offered by Xero in Wave vs Xero:

- E-commerce integrations: For businesses that run online stores, Xero integrates seamlessly with major e-commerce platforms like Shopify and WooCommerce. These integrations allow businesses to sync sales data, track inventory, and automatically reconcile payments from online sales, providing a unified view of both financial and inventory data. This feature is particularly useful for businesses that need to manage large volumes of transactions across multiple sales channels.

- CRM integrations: Xero offers deep integrations with popular CRM platforms such as Salesforce and HubSpot, making it easier to manage customer relationships and financial data together. With these integrations, businesses can track sales pipelines, monitor client payments, and generate detailed reports that combine customer activity with financial performance. This level of connectivity allows businesses to streamline operations and improve customer relationship management without needing to manually transfer data between platforms.

- Payment gateways: Xero integrates with several payment processors, including Stripe, PayPal, and Square, making it easy for businesses to accept payments from clients worldwide. These integrations allow businesses to receive payments directly from invoices and automatically reconcile transactions within Xero. This simplifies the payment process, reduces administrative work, and helps businesses get paid faster.

- Project management tools: For businesses that need to manage projects and track billable hours, Xero integrates with tools like Trello, Asana, and WorkflowMax. These integrations enable businesses to track project costs, monitor timelines, and manage client billing from within their project management software, all while keeping financial data synced with Xero.

Xero’s expansive integration network makes it an incredibly versatile accounting platform that can support the growth and complexity of your business. Whether you’re running an online store, managing a team of employees, or coordinating client projects, Xero’s integrations allow you to centralize your operations and ensure that all your business tools work together seamlessly.

Conclusion: Final Thoughts on Wave vs Xero

When choosing between Wave vs Xero, the decision ultimately depends on the size of your business and the complexity of your accounting requirements. Both platforms offer robust solutions, but they are designed to cater to different types of businesses and financial needs.

Wave is an unbeatable option for freelancers, startups, and small businesses looking for a free, easy-to-use platform that covers essential accounting tasks. If you’re a small business owner or a solo entrepreneur with straightforward financial needs—such as invoicing, expense tracking, and basic financial reporting—Wave provides an impressive suite of core accounting features without the burden of a monthly subscription fee. Its free pricing model, combined with intuitive tools, makes it an excellent choice for those who want to minimize costs without sacrificing the ability to manage their finances effectively.

However, as your business grows and your financial operations become more complex, Wave may start to feel limited. The platform’s restricted integrations, lack of multi-currency support, and absence of advanced features like inventory tracking or detailed financial forecasting make it less suited for businesses that require more comprehensive accounting solutions.

On the other hand, Xero is a powerful solution tailored to the needs of medium to large businesses. While it comes with a price tag, Xero offers an extensive array of advanced features, integrations, and scalability that can handle even the most intricate financial operations. From multi-currency invoicing and global payroll management to project-based expense tracking and detailed financial reporting, Xero is designed for businesses with more complex accounting needs. Its vast integration network—spanning over 700 third-party apps—makes it ideal for companies looking to streamline their entire business ecosystem, from e-commerce and CRM to payment processing and project management.

The flexibility and scalability of Xero make it an excellent investment for businesses that expect to grow or those that are already managing a larger workforce, diverse revenue streams, or international operations. While it’s more expensive than Wave, the depth of its features justifies the cost, especially for businesses that require advanced financial management and the ability to scale operations smoothly. budget, and future growth plans, you can confidently select the best accounting software for your 2024 goals.

3 Alternatives to Wave vs Xero To Consider:

If in the Wave vs Xero comparison you didn’t find the the right fit, here are three great alternatives:

- QuickBooks Online: A comprehensive solution that caters to businesses of all sizes, offering payroll, advanced reporting, and a wide range of integrations.

- FreshBooks: Designed for freelancers and service-based businesses, FreshBooks simplifies invoicing and time tracking.

- Zoho Books: A budget-friendly option with a wide range of features suitable for small to medium-sized businesses.